Individuals in India are mindful and reconsider making interests in land, offers, bonds, and other weighty speculations. Be that as it may, with the developing unpredictability and hazard in responsibility for because of fast change in the cash and capital business sectors, and the expansion in costs of such resources, the world is gradually moving to Partial Proprietorship i.e. Fractional Ownership

Anyway, what is Fractional Ownership?

That is a modern take on ownership of assets. Fractional Ownership is a class of inconsequential financial backers yet pool their monetary assets together to claim a costly and very good quality resource. This speculation strategy permits the financial backer to have money saving advantage but get the co-responsibility for resource, which diminishes the degree of chance in possession as one necessities just a negligible portion of cash to put and risk on the lookout. In Simplest way it can be defined as “Fractional ownership in real estate is a way of buying a portion or percentage of a property. The asset – in this case, a real estate property – is divided up into several parts or fractions, making it available for purchase to a larger number of co-owners with fractional interest

What are the benefits of doing Partial or fractional Ownership?

• Minimal expense of property venture.

• The documentation cycle is advanced, making it quick to put resources into different properties.

• As property venture faces less changes, one can partake in a considerably more steady market.

• One can buy more properties across different areas and sizes through partial possession. Subsequently, accounting for enhancement of venture.

Is it protected to contribute through Fractional Proprietorship?

Fractional Proprietorship is a stand-out putting resources into properties as it doesn’t come down on any single financial backer, permitting them a chance to procure the return for capital invested at a higher speed. These sorts of ventures are made through legitimate and checked entries, which keep the information of different irrelevant financial backers secure. All things considered, it’s a more secure and dependable approach to putting resources into resources that are exorbitant and difficult to keep up with by one individual.

Fractional Ownership is presently an idea, and it has opened up roads for any financial backer putting resources into properties. It has brought the experience of property putting almost comparable to interest in different resources. Be that as it may, financial backers should comprehend the stages and their cycles appropriately before they pick their foundation to put resources into. Partial proprietorship is setting down deep roots and will get better after some time. With speculations starting at Rs.2 lakhs presently, it’s open and reasonable to each financial backer at this point

Contrasted with Conventional Land , Yes. With partial possession, your portion of the land ascends as the worth of the home ascents with the market, very much like entire Ownership at an exceptionally okay and the executives cost.

Conventional Land have an exceptionally sloppy optional purchasing market by which somebody is purchasing the home from the Specialist not straightforwardly from the proprietors, at commonly more then one specialist include which amount to the all out bargain cost and make it intense to sell. rather, in a Fractional Ownership dealer has an its own local area of co-proprietors through which he can straightforwardly offer his portion to them helpfully and bother free.

Yes and no. As it’s still not a widespread financial product, you’ll have to seek out banks that offer mortgages for fractional ownership, as it’s not likely regional or smaller banks would have the systems in place to offer such a loan. However, they are out there. In some cases you can mortgage your shares and opt for loan facility.

Is fractional ownership a good investment? Compared to timeshares, yes. With fractional ownership, your share of the real estate rises as the value of the home rises with the market, just like whole ownership. Timeshares do not have a secondary buying market whereby someone is buying the home from the timeshare owners, rather, a timeshare seller must find a timeshare buyer.

Tenancy in Common: A form of vesting title to property owned by any two or more individuals in undivided fractional inter- ests. These fractional interests may be unequal in quantity or duration and may arise at different times

While some fractionals allow owners to rent out their home when they are unable to use it, the lower cost of buying and owning a fractional means that most owners do not need to use this option. Shared ownership allows the money that would have been needed to own and operate a single vacation home to be spread over two or three vacation homes.

Fractional ownership is a good solution Fractional ownership of commercial property is a unique low-risk, high-return investment option that home buyers can utilise to finance their dream home.

In general, fractional real estate investing allows more flexible operation than traditional real estate investment in various spheres. It allows you to engage professionals; hence, saving you avoidable stress like property management and tenant management.

Partial Proprietorship: Upsides and downsides

Very much like its conventional land and excursion rental ancestors, there are obviously a few downsides to fragmentary proprietorship. The following are a couple of the most articulated benefits and impediments.

Aces It’s more reasonable

Maybe a 1crore home is far off, yet 10 lacs is directly right up your alley. Fractional ownership allows you to get the home you need in the best area at the value you can manage. This goes for home upkeep and support, as well. By sharing the expenses of upkeep, fractional ownership makes long-term ownership a much more realistic possibility..

The home will get some affection

No home ought to pass on empty 48 weeks of the year. By sharing the proprietorship, the home will be opened up at ordinary stretches. Opening and shutting windows and entryways, running the water, turning on the air conditioner and radiator, utilizing conveniences like the hot tub and pool — these are fundamental to keeping up with the home. It provides an opportunity to identify issues early on and preserve the home’s long-term value.

Peace of Mind Fractional ownership also means sharing the burden of home ownership. Rather than a single point of failure (i.e., you), you essentially have a group that shares accountability, schedules maintenance, checks on the home, and divides the work and chores that would otherwise be left to a single owner.

But as with anything, there are downsides to fractional ownership.

Cons Renting can be a tedious task In fractional ownership, selling isn’t as straightforward as whole ownership. While it’s by no means as hard as daily rentals, you’ll have to do research to check on how the ownership is structured and what restrictions may apply with regard to your opportunity to rent your share.

You’re tied into one location

In most cases, fractional ownership is tied to one property. If you or your family likes variety, this arrangement can be limiting. Some properties are part of an exchange program, allowing owners to trade their nights for another location with equal value.

But most owners find it very challenging to match the location with the time of year they like to travel.

So, what came next?

We’ve seen what happened to Traditional Real Estate over the last 10 years, and we’ve seen the bumpy road vacation rentals have taken—with an uncertain future. Now, with fractional ownership on the rise, a new form of ownership that began in early 2020 By an innovative vacation home investment company, has demonstrated success in offering the best way to own and enjoy a collection of premium vacation homes in a diversified Manner.

There are few players are in market who are professionally managing these assets some are known for commercial fractional ownership and some are known for Holiday home fractional ownership like.

BRIK itt- Real Pride of Ownership

Buying into a BRIK offers accredited investors the chance to see returns from traditional real estate appreciation through a diversified portfolio of luxury residences around the world. And just like fractional ownership, the homes in the portfolio are yours to use when you want and are only available to other BRIK-Owners and then to the General Public or Guests.

So, you get the returns of a passive investment vehicle, the control and peace of mind of a Property manager, and the joy of a vacation home, without ever actually having to take care of it, decide how or when to sell it, or come to a consensus with other owners. That’s the perfect combination for luxury vacation home ownership.

Fractional ownership investment options in india

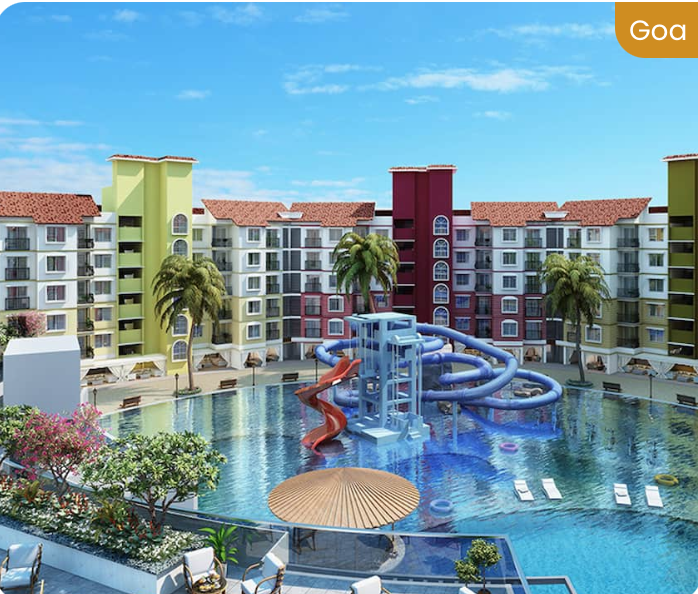

Location : Goa

| Project | Configuration | Investment Amount | Target IRR % |

| AROHA DE GOA | 1BHK | ₹6,99,000 | 16% |

| Project | Configuration | Investment Amount | Target IRR % |

| AROHA DE GOA | 2BHK | ₹8,35,272 | 16% |

location : north india

| Project | Configuration | Investment Amount | Target IRR % |

| SUSHMA ELEMENTA | 1 BHK | ₹6,95,336 | 16% |

| SUSHMA ELEMENTA | 2 BHK | ₹9,49,363 | 16% |

LOCATION : lonavala

| Project | Configuration | Investment Amount | Target IRR % |

| PURANIK’S SAYAMA | 3BHK | ₹32,53,636 | 16% |